August 22nd , 2025

3 minutes

Accounts payable (AP) is one of the most vital yet complex processes in any organisation. AP is the foundation of sound financial management, whether it is through making sure suppliers are paid on time or keeping correct financial records. Inefficiencies, regulatory issues, and manual errors are just a few of the difficulties that many businesses face while processing accounts payable. Fortunately, AP management across sectors is about to undergo a radical change thanks to automation technologies like Intellect's Purple Fabric Accounts Payable.

Challenges Industry Face in Accounts Payable Management

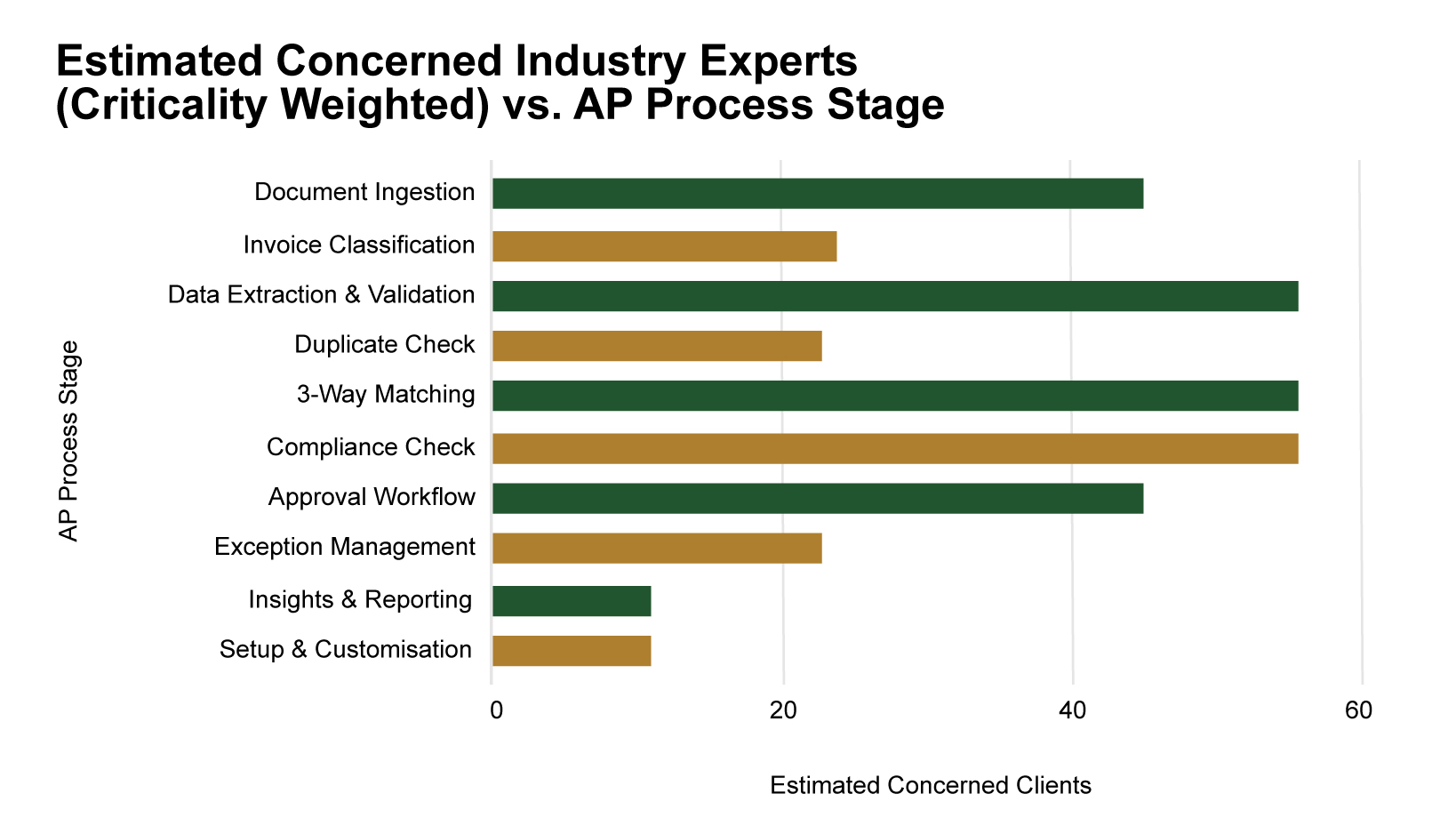

Visual Summary: Where Industry Experts Face the Most Friction in AP

Over the course of 350 Industry Experts demos, we've categorised and quantified the most common concerns raised at each stage of the Accounts Payable process. The graph below illustrates how these concerns are distributed, weighted by their criticality and frequency.

From a study of 350 Industry experts, the biggest AP pain points are Data Validation, 3-Way Matching, and Compliance Checks, each impacting about 16% of respondents. Supporting areas like Document Ingestion and Workflow Approvals are not far behind. A targeted automation strategy addressing these key stages can drastically reduce errors, improve turnaround time, and enhance audit readiness.

Questions Frequently Asked by Industry Experts During Demos

Over the course of showcasing Purple Fabric Accounts Payable to 350 Industry Experts, we’ve identified common pain points based on the questions they consistently ask. These questions are invaluable in understanding where automation creates the most impact:

Despite advancements in financial systems, several core challenges persist in accounts payable:

1. Dependence on Paper-Based Processes

For approval and payment, many businesses still use paper invoices and manual procedures, which causes major delays, inefficiencies, and tracking issues. Human error infiltrates important data points, paperwork is frequently lost, and approvals are sluggish, all of which have an effect on cash flow management and vendor relationships.

2. Lack of Standardisation

Workflows for accounts payable may vary from department to department or business unit. In the absence of established procedures, businesses are subject to human-dependent decision-making, inconsistent invoice handling, and inconsistencies. Frequent mistakes, missing deadlines, and difficulties with regulatory compliance are caused by this unpredictability.

3. Poor Record-Keeping

Precise documentation is necessary for both audit preparedness and internal controls. Yet, many firms struggle with tracking, reconciling, and reporting financial data due to fragmented record-keeping processes. These gaps often lead to inconsistencies and compliance issues that better systems could have easily prevented.

4. Limited Technology Adoption

Many companies continue to handle invoices, match purchase orders, and reconcile payments by hand, even in the face of advanced technology. Insufficient use of automation technologies results in resource waste, slowed processing speeds, and a dearth of useful data insights for improved decision-making.

5. Complex Compliance Requirements

Verification against GSTN, PAN, TDS, purchase orders (POs), and other compliance norms is difficult and time-consuming. Manual checks put businesses at risk since they frequently result in missed validations, duplicate payments, or regulatory fines.

6. Integration and Data Silos

A major barrier to efficiency is the inability to seamlessly integrate AP functions with ERP systems, accounting platforms, and vendor management systems. Disconnected systems lead to duplicated work, data inconsistencies, and a lack of a single source of truth for financial decision-makers.

The Future is Here: Automating Accounts Payable with Purple Fabric Accounts Payable

To overcome these challenges, organisations are turning to Purple Fabric Accounts Payable, Intellect’s intelligent accounts payable automation platform. Powered by seven AI-based assistants, Purple Fabric Accounts Payable provides a comprehensive, streamlined, and compliant AP solution that transforms how businesses manage their financial operations.

1. Eliminating Paper with the Document Assistant

For approval and payment, many businesses still use paper invoices and manual procedures, which causes major delays, inefficiencies, and tracking issues. Human error infiltrates important data points, paperwork is frequently lost, and approvals are sluggish, all of which have an effect on cash flow management and vendor relationships.

Key Capabilities:

Business Impact:

2. Enforcing Standardization with the Orchestrator Assistant

Workflows for accounts payable may vary from department to department or business unit. In the absence of established procedures, businesses are subject to human-dependent decision-making, inconsistent invoice handling, and inconsistencies. Frequent mistakes, missing deadlines, and difficulties with regulatory compliance are caused by this unpredictability.

Features:

Business Impact:

3. Ensuring Record Accuracy with Document & Insights Assistants

Precise documentation is necessary for both audit preparedness and internal controls. Due to disjointed record-keeping procedures, many firms have trouble tracking, reconciling, and reporting financial data. Better systems could have prevented the financial inconsistencies and compliance problems that result from this.

Document Assistant features :

Insights Assistant Features:

Business Impact:

4. Modernising Processes with the Data, Verification & Orchestrator Assistants

Data Assistant automates data extraction and early-stage validation, while the Verification Assistant performs master data checks, duplication control, and procurement validations. Together with the Orchestrator Assistant, these tools eliminate manual dependencies and enhance processing speed.

Data Assistant Features:

Verification Assistant & Orchestrator Assistant Features:

Business Impact:

5. Automating Compliance with the Compliance Assistant

The Compliance Assistant automates critical checks such as GSTN validation, PAN verification, MSME classification, and TDS compliance. Built-in exception handling ensures that potential risks are addressed before they become regulatory issues.

Features:

Business Impact:

6. Enabling System Integration with Seamless Architecture

Purple Fabric Accounts Payable is built for seamless integration with ERP systems, payment platforms, document management solutions, and identity systems. This eliminates data silos and ensures a unified, synchronised financial environment.

Features:

Business Impact:

7. Simplifying Reconciliation with the Reconciliation Assistant

This assistant automates 3-way matching between invoices, purchase orders, and goods receipt notes. It manages PO header and line item validations, quickly resolving mismatches to accelerate payments and maintain vendor satisfaction.

Features:

Business Impact:

Seamless Integration Across Systems

Purple Fabric Accounts Payable is designed for modern enterprises. It easily integrates with ERP systems, payment hubs, identity management and security platforms, and document management systems, ensuring a cohesive and comprehensive approach to financial operations.

Conclusion: A New Era for Accounts Payable

Although accounts payable presents many difficulties, they can be overcome with the correct technology. AP is transformed from a manual, error-prone process into a streamlined, strategic function by Purple Fabric Accounts Payable's comprehensive, intelligent solution.

In addition to automating AP, Purple Fabric Accounts Payable is reinventing its function in modern enterprise finance by resolving inefficiencies, enforcing compliance, and facilitating data-driven decision-making.

Businesses are setting themselves up for long-term development, accuracy, and agility in an increasingly digital world by investing in intelligent AP automation today.

Reference URL: