July 10, 2025

3 min read

Every day, accounts payable teams face a variety of risks from human error to fraud even when precautions are in place. Manual processes, high invoice volumes, and time pressures make accounts payable particularly vulnerable. That’s where the Risk Control Matrix (RCM) comes in. An RCM tailored for accounts payable helps identify potential risks, assess their impact, and document the controls in place to mitigate them. It’s a straightforward but powerful tool that boosts internal controls and builds risk awareness across teams.

In an environment where businesses are encouraged to move fast and adapt quickly, maintaining structure and discipline is more important than ever, especially in finance. An RCM helps account payable departments stay in control, even as they automate and scale. Account Payable teams typically process a large volume of invoices every day, which increases the risk of errors like duplicate payments, mismatches, or fraudulent invoices. When automation is involved, these risks can amplify if not monitored properly. The RCM serves as a framework for managing these risks and aligning them with appropriate controls.

Yet, a framework alone isn't enough. The RCM can only be effective when supported by a smart, agile accounts payable solution that doesn't just execute tasks, but actively detects, responds to, and mitigates risk in real-time. The reality is that most conventional AP systems are reactive. What’s needed is a platform that works hand-in-hand with your control measures, proactively eliminating the very errors and inefficiencies that the RCM identifies. This is where modern technology must step in to translate strategy into secure execution. From fraud detection and duplicate checks to seamless ERP integrations and real-time data intelligence, the future of risk management in AP lies in intelligent automation.

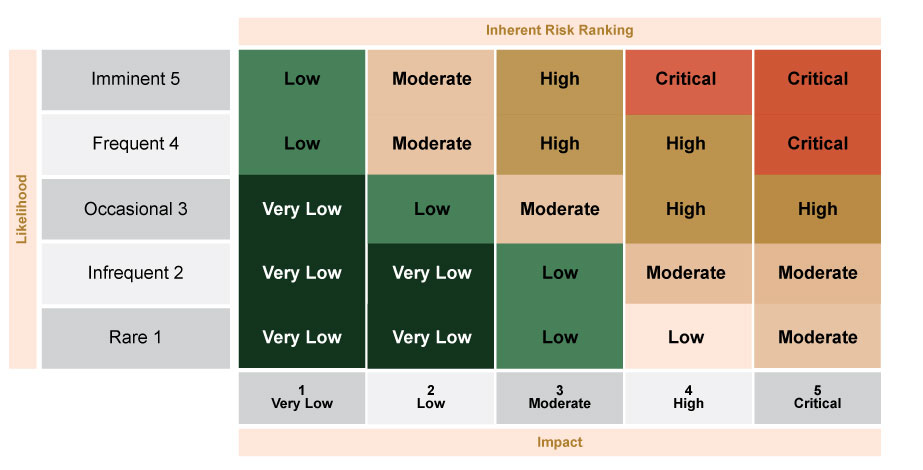

The matrix has two axes. One axis represents the likelihood of hazard occurring. It varies from rare to extreme. The other axis represents the potential impact, if the risk materialised. It could be rated as "very low" or "critical". Plotting these two axes together can help to prioritise the risk depending on its impact, as well as determine whether the current controls are adequate and whether additional actions are required

One of the key strengths of an RCM is how it distinguishes between different types of risk. Inherent risk is the natural level of risk present before any controls are applied, while residual risk is what remains after controls are implemented. Using a simple matrix, risks are typically plotted with the X-axis representing the level of inherent risk, and the Y-axis showing how often the risk occurs. This visualisation helps organisations better understand their risk landscape. It also supports decision-making by showing where controls are strong and where they need to be improved. Over time, combining both the inherent and residual risk views helps organisations build a more comprehensive risk strategy one that not only responds to issues but actively prevents them.

Once developed, the RCM must be clearly understood and applied by the team. This means clearly communicating roles, responsibilities, and expectations. When the staff is aware of potential risks and how to manage them, they’re more likely to follow procedures and spot irregularities early. Ultimately, a well-built and well-communicated RCM doesn’t just protect the company, it also empowers the team.

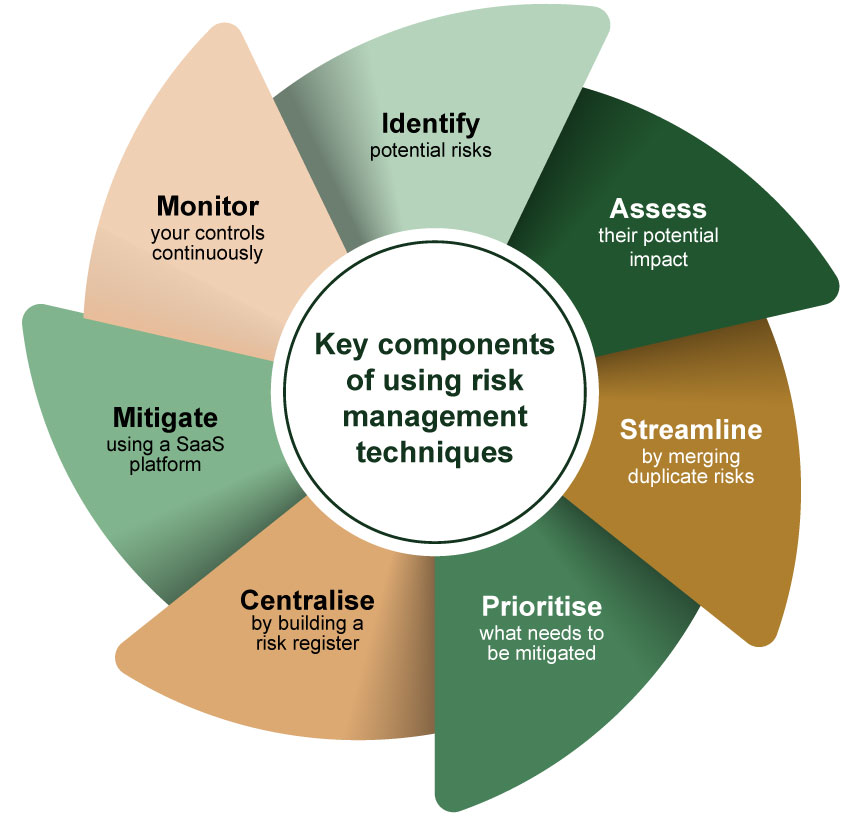

A focused and useful risk assessment plan must be in place to protect the integrity and effectiveness of the accounts payable function. Identifying possible dangers is the initial stage in this procedure. This involves reviewing the entire accounts payable cycle from receiving invoices to approval and payment execution. Fraudulent or constructed invoices, duplicate payments, vendor information inaccuracies, unauthorised transactions, and errors in manual data input are among the areas that are especially vulnerable to risk. Process analysis, transaction sampling, personnel interviews, and exception reporting are all necessary to identify these risks. The company may start to determine where errors are most likely to happen and where controls need to be strengthened by attentively reviewing these areas.

After being recognised, risks need to be grouped based on their likelihood and possible consequences. This categorisation helps decide which risks need immediate attention and which can be handled later. Major risks are likely to occur and can potentially affect operations or finances, requiring immediate attention. Medium-risk risks are defined as those with a moderate impact or possibility, necessitating frequent examination and suitable controls. Low-risk conditions may be checked on a regular basis and, although still significant, usually have little repercussions. In order to effectively allocate resources and make sure that crucial vulnerabilities are not missed, this risk classification is crucial.

The next stage after classifying risks is to establish precise control methods to lessen or eliminate them. There should be a control in place for every identified risk. Implementing system-based checks and three-way matching between purchase orders, invoices, and goods received notes helps prevent duplicate payments. Enforcing stringent approval hierarchies, keeping audit trails, and making sure that duties are segregated so that no one has complete authority over the payment process can all help to lower the likelihood of fraudulent payments. To identify inconsistencies early, controls should also include automated data validation, vendor verification processes, and routine reconciliations.

An RCM should be developed to ensure consistent implementation of policies. It provides a structured framework that outlines each identified risk, its potential impact, and the corresponding control measures. The matrix also details the expected outcomes, review frequency, and designated ownership for implementing and monitoring each control. Serving as a valuable reference for both management and audit teams, the RCM enables a comprehensive view of the organisation’s risk landscape and helps track the effectiveness of its control environment over time.

The RCM must be properly communicated to all pertinent staff members after it is finished. Every team member must comprehend their roles and the significance of following control procedures for implementation to be effective. To reinforce standards and keep the team updated on matrix updates, regular training sessions should be held. The accounts payable team's daily activities should incorporate accountability and clearly outline roles and responsibilities. Effective training and communication guarantee that risk management is integrated into business operations rather than being a one-time event. In this evolving risk landscape, the effectiveness of an RCM depends on the systems that support it. Enter Purple Fabric APX (Accounts Payable eXchange), a next-generation platform designed to bring intelligence, structure, and speed to the accounts payable process.

A well-designed RCM is a useful, strategic instrument that enhances the integrity of the accounts payable department, not just a checklist for compliance. Purple Fabric APX is the world’s most comprehensive, AI-powered accounts payable platform with CDG (Cognitive Data Graph) technology. The technology is powered by twelve global patented algorithms that eliminate duplication and discrepancies by up to 98%. Ensuring a frictionless experience, the platform is enabled by 7 AI-led Assistants that adapt to your workflow, learn from data patterns, and help operationalise your RCM more effectively.

Purple Fabric APX automates everything from invoice ingestion and classification to extraction, categorisation, and validation reducing manual intervention and speeding up payment cycles. This doesn’t just eliminate inefficiencies; it also strengthens the control environment, improves vendor satisfaction, and protects the bottom line.